How India Legalizes Crypto

India already has a regulatory regime for crypto. It's called the Foreign Exchange Management Act.

Previously, I detailed why India should buy Bitcoin. Here we'll discuss why India cannot actually ban Bitcoin, and should instead treat crypto as a foreign currency using its existing foreign exchange regime (FEMA). Our argument proceeds in four parts:

- Why India can't truly ban crypto

- What people think a crypto "ban" could do

- What a crypto "ban" actually would do

- And what India should do: legalize crypto under FEMA

In short, crypto cannot truly be banned for technical, social, and political reasons. The proponents of a ban think it could help Indian national security, but would find that a crypto ban simply shuts down well-lit, regulated exchanges in favor of underground crypto, and causes trillions in collateral damage to boot. Bad actors would not obey a ban, people with the means to do so would move themselves or their money abroad, and hundreds of millions of ordinary Indians would suffer compounding economic losses for every year they are firewalled from this new financial internet.

Countries don’t ban bitcoin. They only ban themselves from the bitcoin network

— unfettered nic carter (@nic__carter) February 17, 2021

The decision is important and the Indian public does not yet appreciate the stakes. If the country legalizes crypto, the positive impact may amount to trillions in both asset appreciation and GDP growth over the 2020s, because crypto is already worth >$1T and growing fast. Conversely, a "ban" would cost India trillions over the long term as the financial internet grows outside the country.

Instead of a "ban", India should legalize crypto, take advantage of its remittance-friendly properties, and resolve potential misuse by extending the Foreign Exchange Management Act (FEMA) to treat cryptocurrencies as foreign assets. Because a ban would revert India to the failed pre-liberalization FERA era, when foreign assets were suspect and trade was inhibited.

Let's now go into more detail, starting with why we put the term "ban" in quotes.

Why India can't "ban" crypto

India can't ban crypto for three reasons.

- It's not technically feasible: math and computer science get in the way.

- It's not socially feasible: brilliant engineers, billionaire financiers, and tens of millions of crypto holders globally present formidable obstacles.

- It's not politically feasible: other states will be launching their own national digital currencies, and India will not be able to prevent them from doing so nor stop them from internationalizing their offerings.

Banning crypto is not technically feasible

To understand why banning Bitcoin is not technically feasible, let's start with something you probably understand: Gmail. You log into Gmail with your address (like yourname@gmail.com) and a password (like lkajsd834908). Anyone can send email to that address, but only you – with the password – can send email from that address.

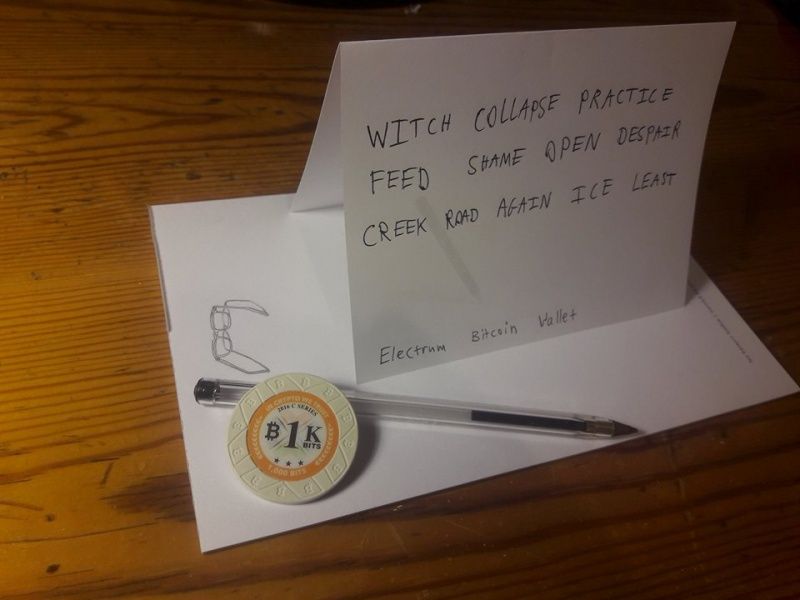

Bitcoin is similar. You have an address (like 3FZbgi29cpjq2GjdwV8eyHuJJnkLtktZc5) and a passphrase (like forget wing follow flip swallow achieve correct view dinner witness hybrid proud). Anyone can send units of Bitcoin (BTC) to your address, but only you – with the passphrase – can send BTC from that address.

There is one big difference, though. With Gmail, if you forget your password, Google can reset it. With Bitcoin, if you forget your passphrase, no one can reset it. The downside of this is that you can lose your Bitcoin entirely. The upside is that no one else (including Google) has access to your passphrase, and that means no one else can move your BTC.

Once you realize that Bitcoin passphrases are literally just a few words that can represent any amount of BTC, you realize how hard it is to actually ban Bitcoin in the sense of seizing BTC from individuals. Each person's holdings can be stored on a tiny text file that no hard drive search will be able to pick up. Transporting a few words across borders is trivial. The words can be hidden in images, and they can be stored offline. And storing a few words for years does not require persistent internet connectivity or even power. You can literally store billions of dollars of BTC on a scrap of paper.

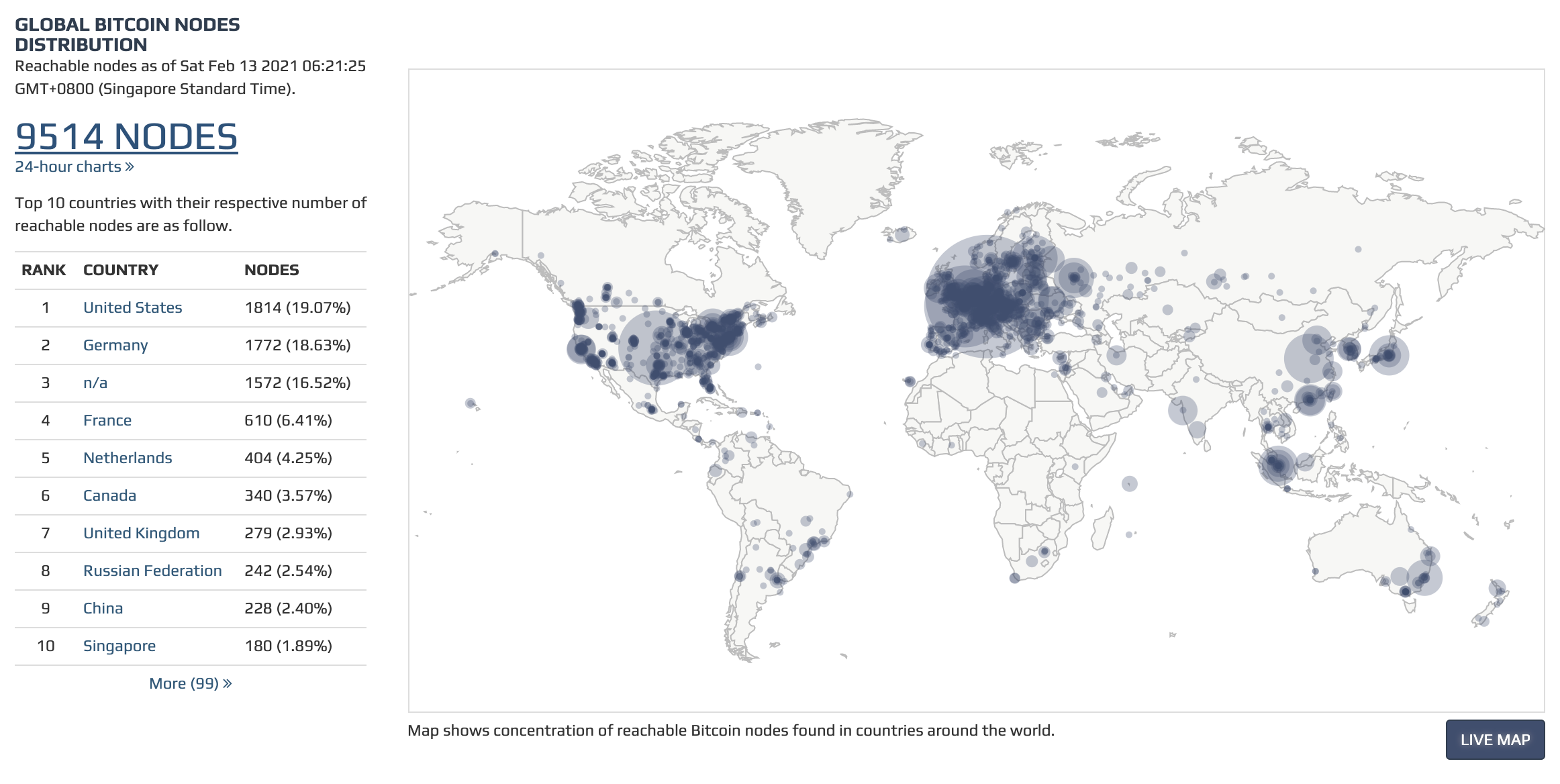

That's BTC held by individuals. What about the global Bitcoin network as a whole, the network of computers that facilitates transfers of BTC between people? That's tough to attack too. The Bitcoin blockchain is replicated on millions of computers worldwide, and cryptographically shielded against any attempt to create new currency, rewrite transaction history, or change account balances. Bitcoin mining and nodes are distributed across many geographic regions, and are situated mostly outside India.

And that's just Bitcoin. There are other cryptocurrencies, like Ethereum. And even if one of these cryptocurrencies fails, it's unlikely they all fail in the same way, because they use different kinds of algorithms. For example, to compromise a proof-of-work currency one might try capturing the physical mining farms located in different countries. But to compromise a proof-of-stake currency you'd need to capture a critical mass of often-pseudonymous individuals around the world.

Moreover, we haven't even gotten to all the new technologies that have been deployed over the last few years like decentralized exchanges, privacy coins, and cross-chain interoperability. All of these make cryptocurrencies as a class (beyond just Bitcoin) harder to seize or shut down.

To summarize: Bitcoin specifically and cryptocurrencies more generally were built to resist bans. For the government to truly stop Indians from making Bitcoin transactions a mere internet shutdown for a day or week or even a year would not be enough. The experience of demonetization is also not applicable, because the issuer of Bitcoin is not the Indian government, and a fiat decree will not reduce the value of BTC to zero.

To really prevent Indians from holding BTC or sending BTC transactions, the state would need to (a) subject the country to an electromagnetic pulse or mass degaussing sufficient to destroy all forms of memory storage, (b) ban all immigration and emigration indefinitely, and (c) stop all forms of communication entirely with people outside the country (including physical mail) to prevent anyone from sending a few words out of India.

Clearly this is infeasible, which is why a Bitcoin ban is technically infeasible.

Banning crypto is not socially feasible

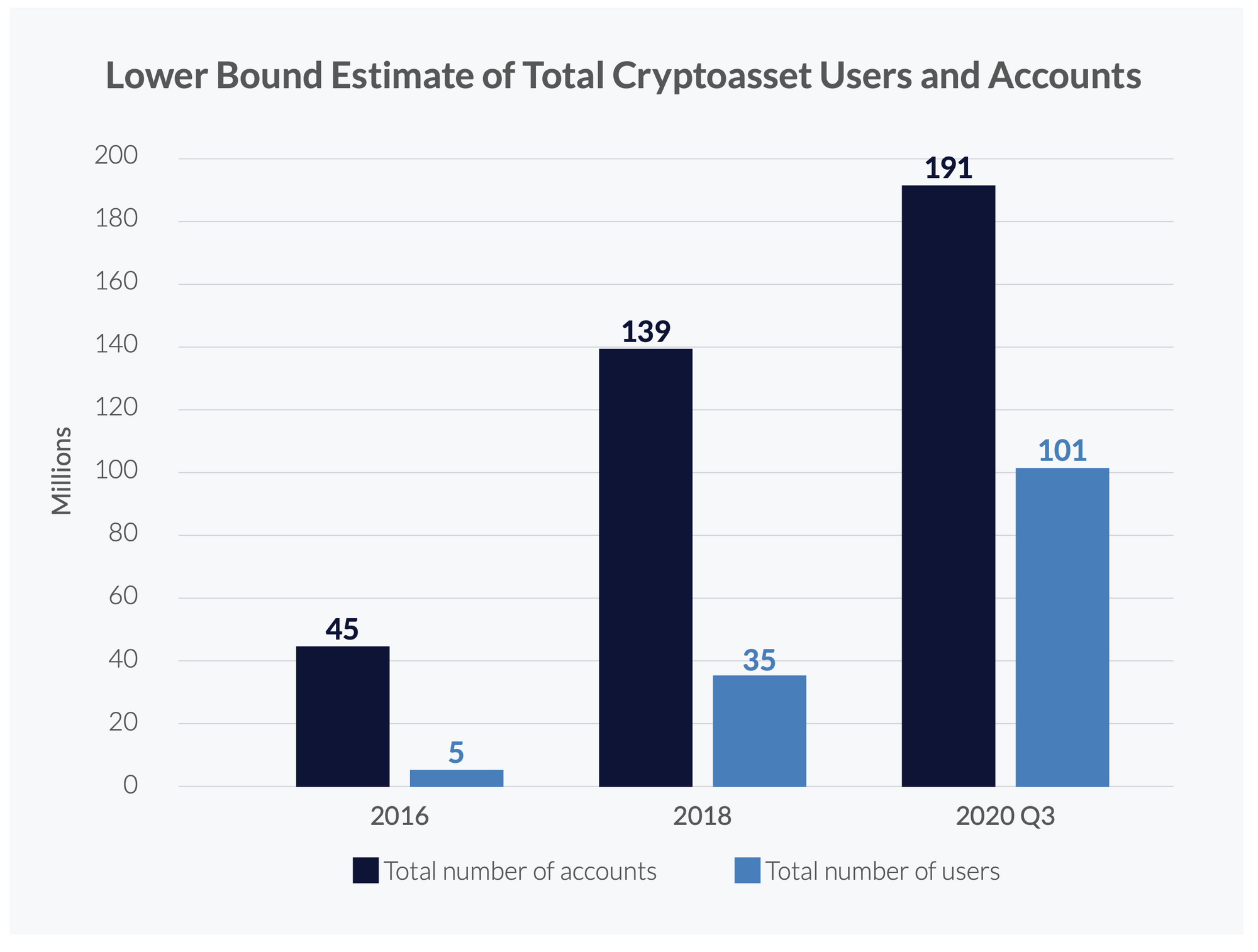

From a social perspective, Bitcoin specifically and cryptocurrency more generally now boasts ~100M users and enjoys broad support among the world's tech and financial elite. We're talking about billionaires, CEOs, cryptographers, engineers, founders, entrepreneurs, venture capitalists, and angel investors. Along with an increasing number of human rights activists, athletes, celebrities, and influencers.

These are resourceful, connected, internationally mobile people who have been preparing for possible restrictions on cryptocurrency for many years. Many of them are ideologically dedicated to the success of cryptocurrency, well before it was as economically impactful as it is today. Many others have billion dollar businesses which are dependent upon the continued and expanded legal acceptance of cryptocurrency. Given that crypto is a significant part of their identity, net worth, and/or business, a "ban" in one country will just result in relocation to another domicile. This includes crypto-holding Indian founders, entrepreneurs, and VCs who would otherwise have invested in or done business in India.

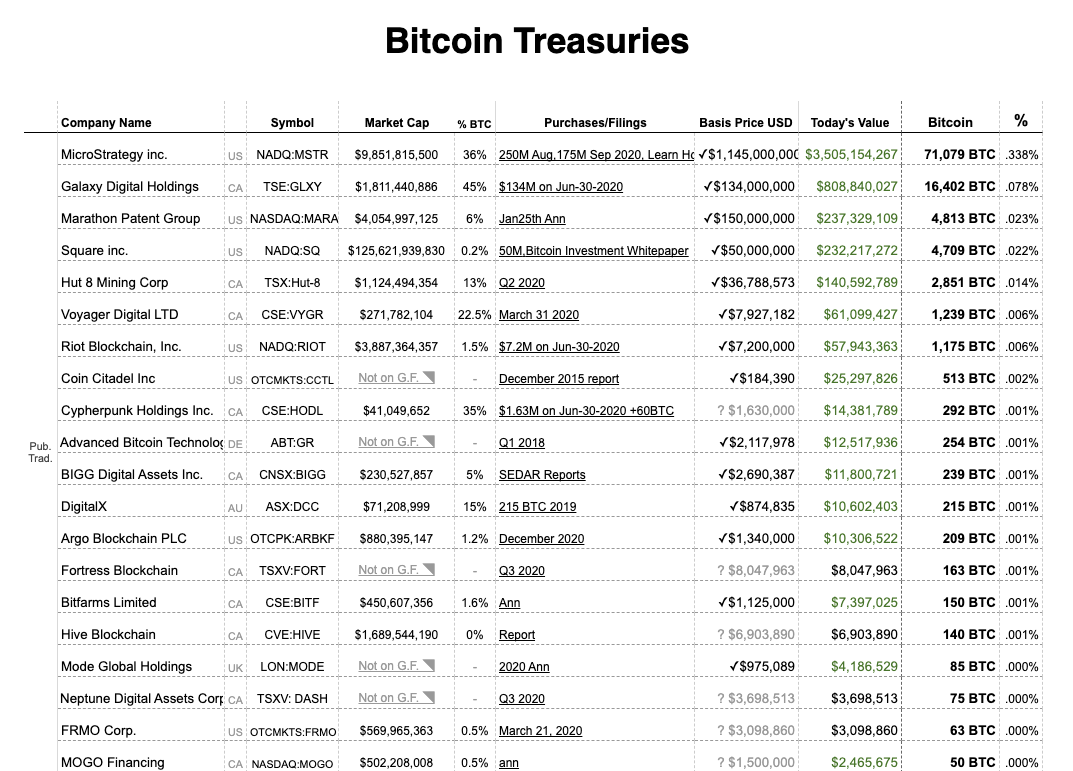

Socially, Indians will respond to a ban by moving overseas to found crypto companies or investing in one of the any foreign entities that now have exposure to cryptocurrency (like MSTR or Tesla). So from a social perspective, all a "ban" does is increase the cost of holding crypto for Indians, and stop crypto investors and founders from entering India.

Banning crypto is not politically feasible

Perhaps the most interesting reason that countries can't ban crypto is that they can't ban other countries. Because we are about to enter a new age of global monetary competition.

Recall that when Google News launched in 2002, it suddenly pitted every newspaper against each other. Geographic monopolies began evaporating. Local newspapers that didn't publish much in the way of local news found that reprinting the same AP headline as everyone else was no longer a viable business model.

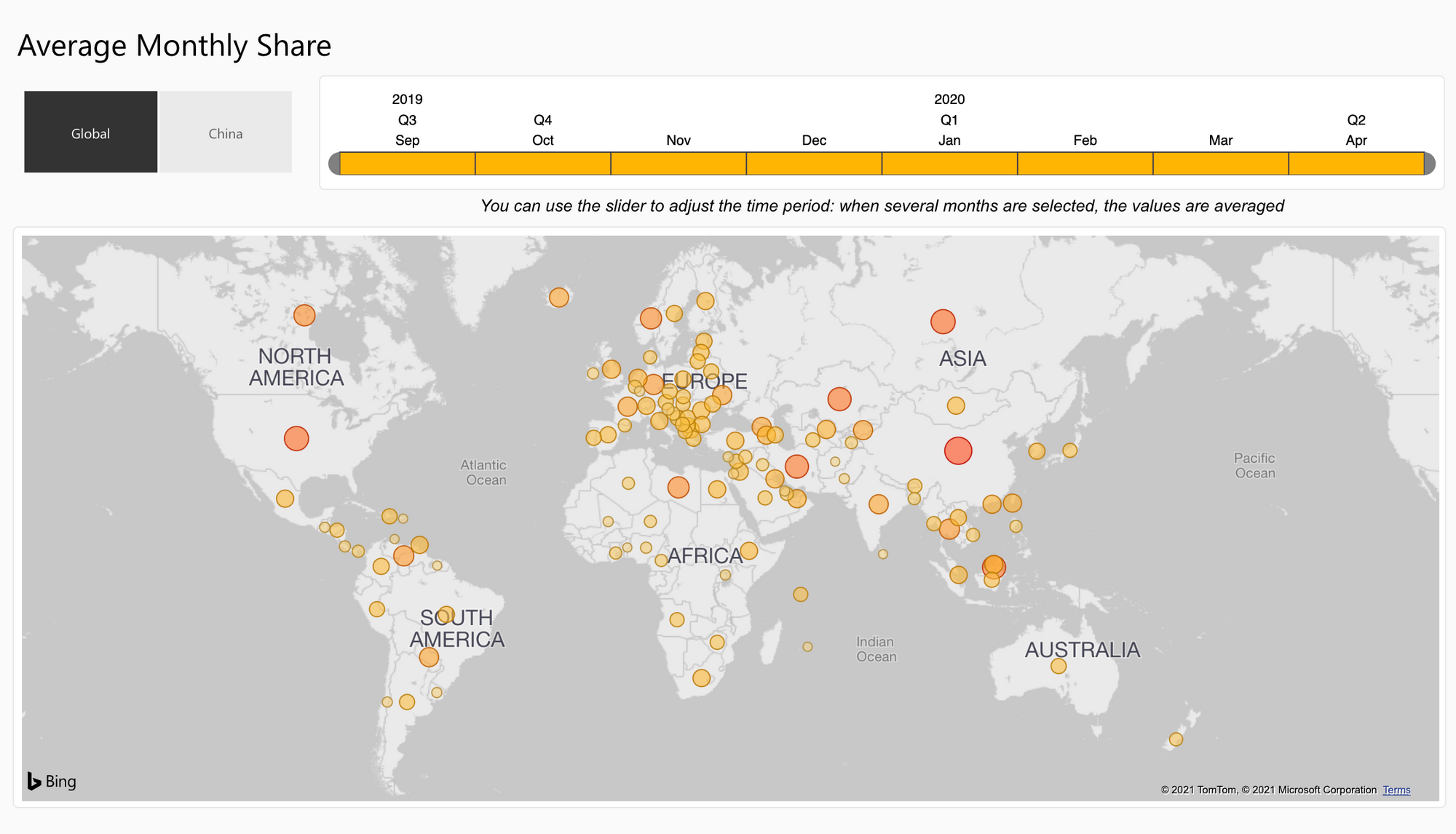

The same thing is about to happen over the 2020s as multiple countries begin launching national digital currencies and we go from 100M+ cryptocurrency owners to 1B+. Each country will face a tradeoff between centralized control and global adoption of its national digital currency, between power and money.

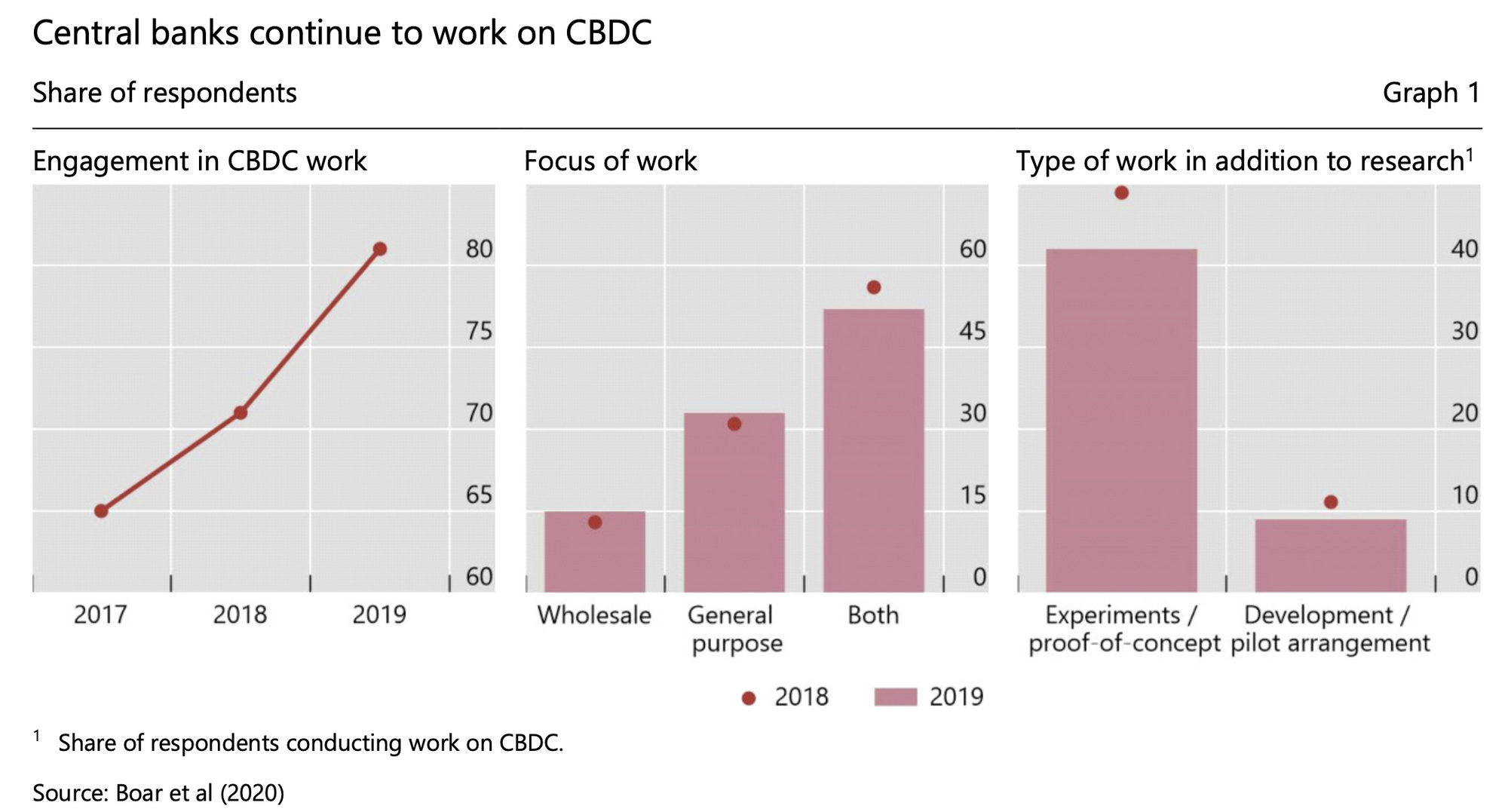

The obvious design for a national digital currency is to simply back it by a centralized database which only approved government users control, to surveil every transaction, to require it for all domestic transactions, and to ban all competing digital currencies to spur adoption. This is similar to India's reported course of action with the digital rupee.

But this obvious approach immediately runs into a problem: a state that tries forcing its citizens to adopt a national digital currency domestically will soon need to contend with the reality of unbannable international currency competition, for the following reasons.

1. First, other countries will continue to exist, and will also issue national digital currencies. It isn't just China and India that are talking about national digital currencies. So are many other states. And these states will continue to exist, as not even a superpower can invade the world or control everyone's monetary policy.

2. Second, some nations will want to internationalize their national digital currency such that it is held abroad. Currency internationalization is the widespread use of a currency outside the borders of its country of issue. The Chinese have sought to internationalize the RMB since the late 2000s, and there is discussion within India over whether to internationalize the rupee. There are both costs and benefits to currency internationalization, but let us assume that at least some nations will want to internationalize their currency for the economic benefits and soft power of having their national currency widely accepted and held abroad.

3. Third, some countries will facilitate trades between national digital currencies and cryptocurrencies. This is already true, as we see financial centers and technology capitals like Singapore, Dubai, Switzerland, Miami, and Estonia embracing crypto. The reason is obvious: crypto generates enormous economic benefits for the nations that adopt it. And these financial centers will facilitate the international exchange of national digital currencies and cryptocurrencies.

The City of Miami believes in #Bitcoin and I’m working day and night to turn Miami into a hub for crypto innovation.

— Mayor Francis Suarez (@FrancisSuarez) January 27, 2021

Proud to say Miami is the first municipal government to host Satoshi’s White Paper on government site. @balajis @tyler @cameron @APompliano pic.twitter.com/DBOni23ynY

4. Fourth, nations can't easily stop their citizens from holding foreign digital currencies or cryptocurrencies on their computers. Cryptocurrencies and other digital assets are, by their design, so-called "bearer instruments". A user holds the private keys to their cryptocurrency on their laptops. As for national digital currencies, we don't yet know how the Chinese digital yuan will work or what other countries will do. However, if any national digital currencies are implemented like the USD-based stablecoins that are already widely adopted, they would also allow users to hold the equivalent of an API key locally while retaining administrative rights at the blockchain level to use under exceptional circumstances. In this model, you'd have a file on your computer or phone which represents "digital cash" in a national currency, and which applications could use for normal transactions, but which the issuing state could freeze or reverse in extraordinary circumstances.

5. Fifth, nations won't give other nations root access over their own national digital currencies. Brazil wouldn't let India administer the digital real, just like India wouldn't let Brazil administer the digital rupee. The entire purpose of a national digital currency is monetary sovereignty.

So, taken together these five points outline the political rationale for why banning crypto is not feasible: it would mean banning national digital currencies from foreign states.

Bans won't work beyond borders

When you combine the technical, social, and political vantage points, it becomes clear that any country that tries to "ban crypto" will not succeed in banning crypto beyond its borders. Decentralized cryptocurrencies will continue to exist after any "ban", and will be legal in at least some countries like Switzerland and Estonia. National digital currencies for other states will also continue to exist after a "ban". And in the event of a "ban", people will move abroad or buy interests in foreign entities to gain exposure to decentralized cryptocurrencies and other national digital currencies.

Seen from another perspective, one country's national digital currency is another country's foreign cryptocurrency. For India, the commonality between digital gold and the digital pound is that India doesn't have control over either digital gold or the digital pound. So both technically unbannable cryptocurrencies and politically unbannable national digital currencies will remain available in cyberspace, regardless of domestic policy.

Bans will be porous within borders

The international context affects the domestic context. Many decentralized cryptocurrency networks have millions of users, and have userbases as large as small nation states. Virtually every such network wants "foreigners" to hold its cryptocurrency in order to grow its market capitalization and adoption. And many national digital currencies will be internationalized national digital currencies which are meant to be held by foreigners, like a digital Swiss franc.

We can see a sneak preview of what a crypto "ban" would look like in Nigeria. Ministers realized it couldn't be stopped, and are now talking about turning things around.

“We didn’t create Cryptocurrency and so we cannot kill it and cannot also refuse to ensure it works for us. These children are doing great business with it and they are getting result and Nigeria cannot immune itself from this sort of business." - Senator Biodun Olujimi

— The Nigerian Senate (@NGRSenate) February 11, 2021

A new age of global monetary competition

Because all these other cryptocurrencies and foreign digital currencies will be accessible over the internet, we are entering an era of global monetary competition. Over the next ten years hundreds of millions of people will own many different kinds of digital assets, including cryptocurrencies, foreign national digital currencies, and the national digital currency of their own state.

All of these will compete against each other, because it will be easy for someone to hold a portfolio of (say) BTC, ETH, digital stocks and bonds, the Brazilian digital real, and the Indian digital rupee on their own computer. The digital rupee will not be able to win this competition with a simple ban, because people will choose their portfolio of currencies based on several characteristics.

- Coercion. Does the state require them to hold it? This is the impact of a ban, but compliance with any ban cannot be assumed to be 100%.

- Upside. Does the asset offer the upside of a Bitcoin or Ethereum, which have appreciated 10000X+ over the last decade? If this is life-changing enough, then people will change their lives to get around a ban by moving abroad or buying shares in overseas vehicles with crypto exposure.

- Adoption. Can they buy relevant goods and services with it? Is it used by people in their social network?

- Privacy. Does the currency protect privacy? Note that for the same reason Signal is drawing users from WhatsApp, private money will tend to outcompete surveillance money. In other words, there is a real economic cost to financial surveillance.

- Transparency. Does the asset allow for cryptographically verifiable transparency, to facilitate accounting and financial statements?

- Multisignature. Does the asset allow multiple users to sign transactions? For example, to facilitate disbursement of funds upon a corporate board vote.

- Programmability. Does the digital asset facilitate programmability, such as the use of Ethereum-based smart contracts? This is a very important use case that facilitates new kinds of programs and protocols.

- Scalability. Does the asset support a large number of transactions per second, as is required for applications like micropayments?

- Monetary Policy. Does the asset have a stable and predictable monetary policy, like Bitcoin? For example, can you predict the inflation rate several years out?

- Reversibility. Is the asset error-tolerant? Is there a system administrator that can be contacted to reverse transactions, as with a wire transfer?

- Censorship-Resistance. Is the asset censorship-resistant, such that there is no system administrator that can reverse any transactions, as with a Bitcoin transfer?

- Volatility. Does the asset change in value from day-to-day, or is it relatively stable like a "stablecoin" or national digital currency?

Note that coercion is just one feature in this feature matrix. That is, a domestic crypto "ban" is an incentive. But it's not a fully determining one, particularly when you consider the life-changing 10000X+ upside that comes from holding crypto assets like Bitcoin or Ethereum, and the fact that crypto will remain legal abroad in at least some jurisdictions. If India makes technologists choose between holding crypto and operating in India, many will choose to hold crypto.

In summary: because India can't actually ban decentralized cryptocurrencies and national digital currencies beyond its borders, it will have to compete on more than just a ban. The digital rupee will have to compete on its features. It will need to outcompete all other national digital currencies and cryptocurrencies to be widely adopted. It won't be able to win solely on the basis of coercion. Smart politicians around the world understand this; even New York City must adopt crypto to maintain its status as a financial capital now.

As mayor of NYC - the world’s financial capital - I would invest in making the city a hub for BTC and other cryptocurrencies.

— Andrew Yang🧢🗽🇺🇸 (@AndrewYang) February 11, 2021

What people think a crypto "ban" could do

Now let's shift gears for a second. Why do people want to resort to coercion, to a ban in the first place? What do they think it could do? Let's empathize with them.

We don't yet have draft language for today's proposed ban, but the draft bill from 2019 lists four proposed reasons to ban crypto currencies. To paraphrase, here's what people who want a ban in 2019 were concerned with:

- National security. Bad actors are sending money into India to stir up violence and agitation, and fund terrorism. Just like demonetization, we want to cut off dark money flows and a crypto ban, even if imperfect, will help with that.

- Consumer protection. The volatility of cryptocurrencies means that people can lose money, and we need to protect consumers from downside.

- Energy consumption. The energy consumption of proof-of-work currencies like Bitcoin is very high, and we want to save energy.

- Monetary policy. Because they can't be controlled by the government, cryptocurrencies themselves imperil monetary policy and national sovereignty.

Proponents of the 2021 ban have added an important new wrinkle. They say that you can do blockchain without crypto, with a digital rupee on a permissioned ledger that has none of these issues. Their thinking is that bad actors can't use digital rupees as easily because the RBI would have root access, the rupee is stable, a permissioned ledger doesn't consume energy via Bitcoin-like mining, and it integrates directly with the country's monetary policy. So, their belief is that if you could ban all digital currencies, you could just get the good features with a digital rupee with none of the bad, and solve the national security, consumer protection, energy consumption, and monetary policy issues listed above.

The issue is that while a digital rupee is indeed a good idea, none of these four desired goals will be achieved with a "ban".

What a crypto "ban" would actually do

Let's go through what the crypto "ban" would actually do.

National security: a ban hits good actors, not bad ones. First, as detailed above, you won't be able to ban bad actors from sending and receiving cryptocurrencies because (a) at the human level, bad actors won't comply with the law and (b) at the technical level, a ban would mean banning the internet and destroying all hard drives. Instead what a ban would do is shut down all legal crypto exchanges and push crypto into the underground, expanding the space for bad actors to operate rather than contracting it. As the saying goes, if crypto is outlawed, only outlaws will use crypto. Millions of law-abiding Indians would comply with the law...but only grudgingly, knowing that friends and relatives were getting wealthy from crypto abroad, that other countries had legalized it, that the world was adopting it, and that they were being left out.

Consumer protection: taking away downside means taking away upside. Second, the upside of crypto more than compensates for the volatility. Just look at the charts: Bitcoin and Ethereum are the best performing assets of all time, beating every startup of the 2010s, and globally accessible to virtually any investor – not just the few with the connections to get into great startups. So, while a digital rupee would take away the downside, it would also take away the upside. No one is getting rich holding an asset with zero volatility. Again, many Indians would try to figure out ways to circumvent the ban, by going overseas, buying stakes in foreign companies with exposure to crypto, or simply flouting the law. The state would be in the awkward position of preventing people from getting wealthier – the opposite of economic liberalization.

Energy consumption: crypto improves renewable pricing. Not only is 70% of Bitcoin mining now powered by renewables, the World Economic Forum (Davos) has noted that Bitcoin actually improved the economic competitiveness of renewables themselves, by storing power that would otherwise be wasted in the form of mined BTC. Moreover, newer cryptocurrency designs like Ethereum's proof-of-stake don't use mining at all.

Monetary policy: crypto is an alternative to USD and RMB. I went into this in my previous post, but the main point is that only governments that want to engage in Venezuela-like money printing will be significantly constrained by Bitcoin. Governments that buy Bitcoin will find their treasuries rise with time. And governments that legalize cryptocurrencies as part of the financial internet will find that they are robust to both American and Chinese abuses of the international financial system, because they'll have a huge domestic crypto sector they can turn to in the event of trouble.

So, the crypto "ban" would harm national security by pushing crypto underground, make Indians poorer, harm renewable energy, and reduce India's flexibility with respect to international monetary policy.

Trillions of dollars in collateral damage. A ban would also cause many other forms of collateral damage, including:

- India would lose out on years of compounding appreciation in crypto assets

- India would lose access to the financial internet

- Tech personalities with large amounts of crypto like Elon Musk, Marc Andreessen, and Peter Thiel would not be allowed in the region

- Tech companies with large amounts of crypto like Tesla would face an uncertain legal and accounting regime

- Indian crypto founders and investors would leave the country

- Crypto investment and remittances wouldn't be able to come into the country

And because crypto would continue to grow outside India, the country would gain nothing in the end as India will eventually need to U-turn in 2025 or 2030.

Disrespect for the law. Unlike a ban on violent crime, which has the support of 99% of the population, a crypto ban will be perceived as a way to stop Indians from getting wealthier or joining in the development of the financial internet – particularly once Indians see people in other countries embracing crypto and growing as a consequence. Though the ban is aimed at bad actors, they are by their nature likely to flout any rules. The ban's actual damage will fall upon India's best technologists and financiers – and that will serve to inadvertently alienate them from India.

Poverty harms sovereignty. Just to linger on this point for the people who weigh the national security argument very heavily, it's worth remembering that poverty harms sovereignty. A poor India, or an India that is poorer than its rivals, is a weak India. That's why the Chinese have their saying: the backwards will be beaten.

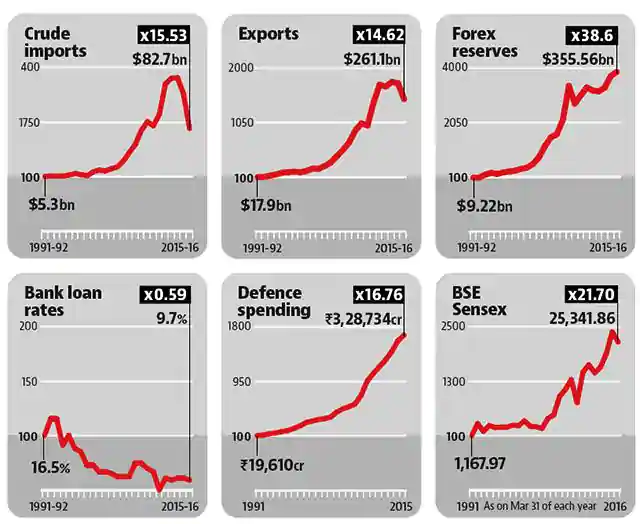

So, let's suppose India closes itself off to crypto, tries to firewall the financial internet. What happens then? It's not banned worldwide, as noted above. And so your country just becomes relatively poorer over time. The total market capitalization of all cryptocurrencies right now has risen from $0 to $1T in a decade. Some of the subareas within crypto like defi are at $30B and rising vertically. You don't normally see something that big growing that fast. If crypto rose from even $1T to "just" $10T in another 10 years, India (with annual GDP $3T) would lose out on its share of $9T in crypto appreciation alone.

Thus, even if the only goal is national security, you could buy a lot of defense infrastructure with that money. There are cheaper and more surgical ways to identify bad actors than a "ban"; just allow well-lit, regulated crypto exchanges rather than criminalizing a technology that helps Indians build wealth and strengthen the country.

What India should do: regulate crypto under FEMA

We've gone over why India can't technically, socially, or politically enforce a ban on cryptocurrencies, what the state is trying to accomplish with a ban, and what a ban actually would do. Now let's discuss what India should do.

First, a Bit of History: Why Did FEMA Replace FERA?

In 1999, India moved from a “currency regulation” regime (FERA) to a “currency management” regime (FEMA). The former was supposed to conserve foreign exchange reserves, while the latter optimized for facilitating external trade and payments, while building an orderly forex market.

Why the change? Well, FERA didn't actually conserve foreign exchange reserves. In reality it had the opposite effect:

The Foreign Exchange Regulation Act (FERA) was legislation passed in India in 1973 that imposed strict regulations on certain kinds of payments..the tenor and tone of the Act was very drastic. It required imprisonment even for minor offences...FERA was repealed in 1998 and replaced by the Foreign Exchange Management Act, which liberalised foreign exchange controls and restrictions on foreign investment.

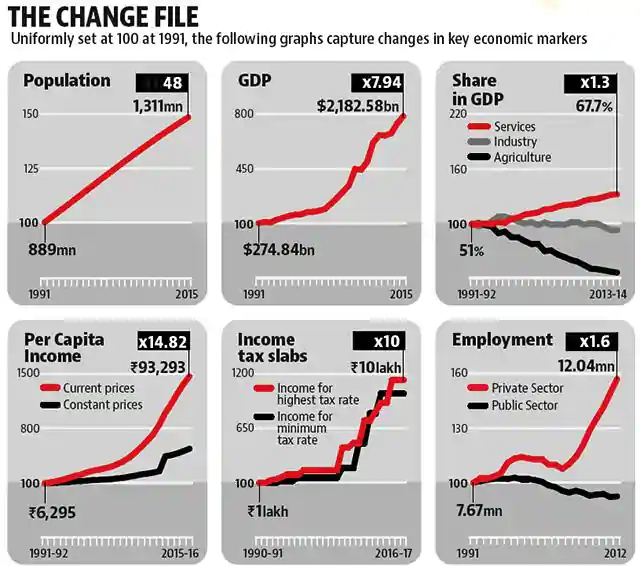

The shift from FERA to FEMA, from a closed to open system, was a foundational shift in policy linked to India's integration into the global economy. As background, foreign investment in the country had increased ~40X from US$132M in 1991–92 to $5.3B in 1995–96.

The graphs were up and to the right, and it was in this context that FEMA was enacted, as it acknowledged the need for capital to flow into and out of the country subject to reasonable constraints. By 2006, in part aided by FEMA, India recorded a GDP growth rate of 9.6%, becoming the second fastest growing major economy in the world, next only to China.

History repeats. The graphs are again up and to the right, except they're in the new blockchain-based financial system rather than the old one. And India once again faces a choice between a closed currency system and an open one, between the Licence Raj and a liberalised regime. But this time it's not FERA vs FEMA, it's crypto ban vs crypto boom. The next step is clear: let Indians access the emerging financial internet by expanding FEMA-like regulation to make crypto safe and legal for all.

India should regulate crypto under FEMA

Basically, India doesn't need to take a risk with a novel ban on the financial internet. It can just modify FEMA to regulate decentralized cryptocurrencies and national digital currencies as foreign assets. A 64-page report by the Indian law firm Nishith Desai Associates outlines in detail how that could work. In brief, the report recommends:

- Treating crypto as a foreign asset. FEMA provides language that could be used to expressly classify digital assets as "securities", "goods", "software", or "foreign currencies" depending on their features and attributes.

- Regulating exchanges with startup-friendly licensing. RBI could use FEMA to regulate crypto exchanges as "authorised persons" per the Act, thereby permitting them to deal in foreign currency. Some provision would need to be made to accommodate startups, perhaps by monitoring small new licensees under a regulatory sandbox framework. By repurposing this well-established regulatory mechanism, crypto-assets become subject to all the existing safeguards that the Act provides, including RBI oversight and KYC/AML.

- Adopting KYC/AML rules. Most developed jurisdictions, including Australia, Canada, the EU, Japan, South Korea, and the US, have brought crypto-asset business activity within their AML regimes. Such an approach has also been recommended by the FATF. India can do this with a simple Central Government notification under the Prevention of Money-Laundering Act.

The FEMA-based model (or a close alternative) would allow us to turn all licensed, regulated Indian exchanges like CoinDCX, WazirX, Coinswitch, Zebpay, Unocoin, and Pocketbits into well-lit venues for trading cryptocurrency. Over time, they will also become huge drivers of remittances for Indians abroad performing remote work, thereby bringing capital into India.

Conclusion

In summary, India should regulate crypto using its proven foreign exchange regime rather than imposing a hasty "ban" on the emerging financial internet. While specific details can be worked out, we think the concept is directionally right, because liberalizing foreign exchange was one of the most important steps in turning India away from the pre-liberalization era.

Once India thinks about liberalizing crypto as analogous to liberalizing foreign exchange, we put things into the proper context. We realize that India can't ban Bitcoin anymore than it can ban gold, or the pound, or a future digital pound. We realize that the mere possession of gold or the pound by Indian citizens has not endangered India, and neither will the possession of digital gold or the digital pound. And finally, we realize that legalizing crypto will open up India to the financial internet, just as liberalizing foreign exchange opened up India's financial markets.