The Fiat Crisis

This is not a financial crisis. It’s a fiat crisis.

I just burned a million to tell you they’re printing trillions. Watch the video (also embedded below) for context, then read on for details.

I just burned a million to tell you they're printing trillions. pic.twitter.com/pX5622rjUO

— Balaji (@balajis) May 2, 2023

The Million

As noted in the video, the million dollar bet is now closed out by mutual agreement. I made $1M+ in provable on-chain donations, which you can verify by clicking the links below:

- $500k to Bitcoin Core development via Chaincode (block explorer, tweet 1, tweet 2)

- $500k to Give Directly (block explorer, tweet)

- $500k to Medlock (block explorer, tweet)

So, I settled the bet[1] ahead of time and donated even more than I had committed ($1.5M vs $1M). But why?

Thing is: I’m not a trader, I’m not John McAfee, and I’m not in the habit of publicly burning a million bucks. The reason I did this was because I do believe in the public good, but unfortunately we can't rely on the public sector anymore to tell us when something's wrong. After all, Janet Yellen reportedly knew the 2008 crisis was coming, but didn't sound the alarm.

So instead I spent my own money to send a provably costly signal that there’s something wrong with the economy, and that it's not going to be merely a financial crisis, but a fiat crisis.

And that brings us to the trillions.

The Trillions

On April 10, 2008, after his Fed intervened in a massive bank failure, Ben Bernanke reassuringly told us we might be facing a “mild" recession. Within 158 days, the world realized it was actually in the midst of a devastating global financial crisis. Wall Street ran to the exits before Main Street even knew what was happening…and then the printing of trillions began.

Almost fifteen years to the day later…on April 13, 2023, after his Fed intervened in a massive bank failure, Jerome Powell reassuringly told us we might be facing a “mild” recession. But this time, the world may soon realize it’s actually in the midst of a global fiat crisis. And this time, the world might get to the exits before the Fed uses them as exit liquidity…if they can get there before the printing of trillions begins.

And that’s why I burned a million to tell you they’re printing trillions. Early warning of the next Fed-precipitated global meltdown is easily worth more than a million to the public good, because the world can now exit Fed control in ways we couldn’t in 2008.

Put another way, Powell keeps talking about a soft landing, so he’s admitted he’s the pilot. You and I are just passengers in his plane. And me, and others like me, think he isn’t taking us in for a soft landing or a hard landing…but a crash landing. You can just sit tight in your seat, or you can at least understand why so many are going for the parachutes.

The Fiat Crisis

The short version is that this meltdown may be worse than 2008. (Morgan Stanley agrees, by the way.) There’s so much that’s simultaneously broken in the economy, even after (and partly because of) the artificial prosperity of 2021. There aren’t enough healthy sectors to bail out the failing sectors. Too many things are failing at once.

Specifically, we have an economic polycrisis — a combination of banking crisis, debt ceiling crisis, municipal budget crisis, bond crisis, commercial real estate crisis, Ukraine crisis, de-dollarization crisis, auto loan crisis, credit card crisis, medical debt crisis, student loan crisis, insurance crisis, trade war crisis, energy crisis, and sundry other cascading crises all happening at the same time, each with a ~$100B-$1T+ price tag.

Go click those links. Some of these crises are already well underway, while others are just beginning. But as each of them blow up, the combined effect will cause a massive economic contraction — not the “mild recession” that Powell claims. The Fed will then be forced to print trillions to stimulate the economy and bail out each too-big-to-fail industry.

But it probably won’t look exactly like 2008. After all, right now the Fed isn’t doing “quantitative easing“ (QE), you see…instead they’re hiking interest rates to kill banks, while also printing trillions to bail out the banks they’re killing. Meanwhile, the politically powerless public at large suffers the effects of both high rates and high inflation, without access to the money printer. It’s banana republic banking, optimized only for optics: the illusion of tight monetary policy with the substance of anything but that.

Eventually there may be a push for printing to be structured as “the people’s QE”, with direct cash transfers to accounts, similar to the COVID stimulus, but even more inflationary. Luke Gromen thinks this will probably be a surprise, similar to the surprise rate hikes.

All this is happening at the same time the US is drawing down its strategic petroleum reserve, spending down the Treasury General Account, sharply increasing its debt, preparing for simultaneous conflict with both Russia and China, alienating its allies, experiencing antebellum levels of internal polarization, blocking the exits to other currencies, and suffering high levels of inflation.

Whatever the mechanism, flooding the system with money when it’s already under stress and experiencing high inflation will cause the fiat crisis: a loss of global faith in the US financial system, followed by the attempted introduction of digital lockdown via a CBDC-equivalent, accelerated physical emigration from blue states, and associated capital flight from the dollar to assets like gold, Bitcoin, and foreign currencies outside the control of the Federal Reserve.

Or, of course, the system could just muddle through as it has been doing. And that is the key question: do we have months, years, decades, or centuries before the Fed prints its guts out?

How and when does the US default?

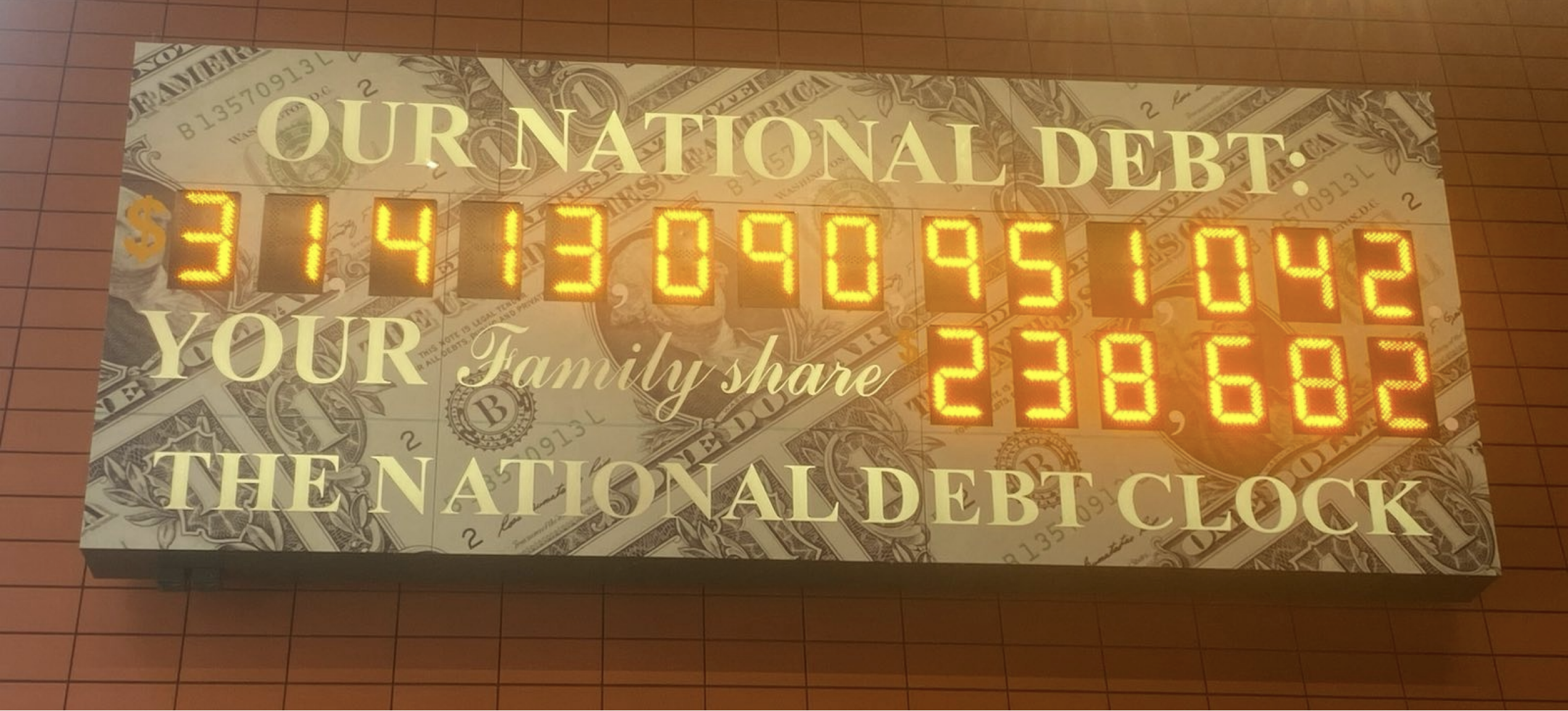

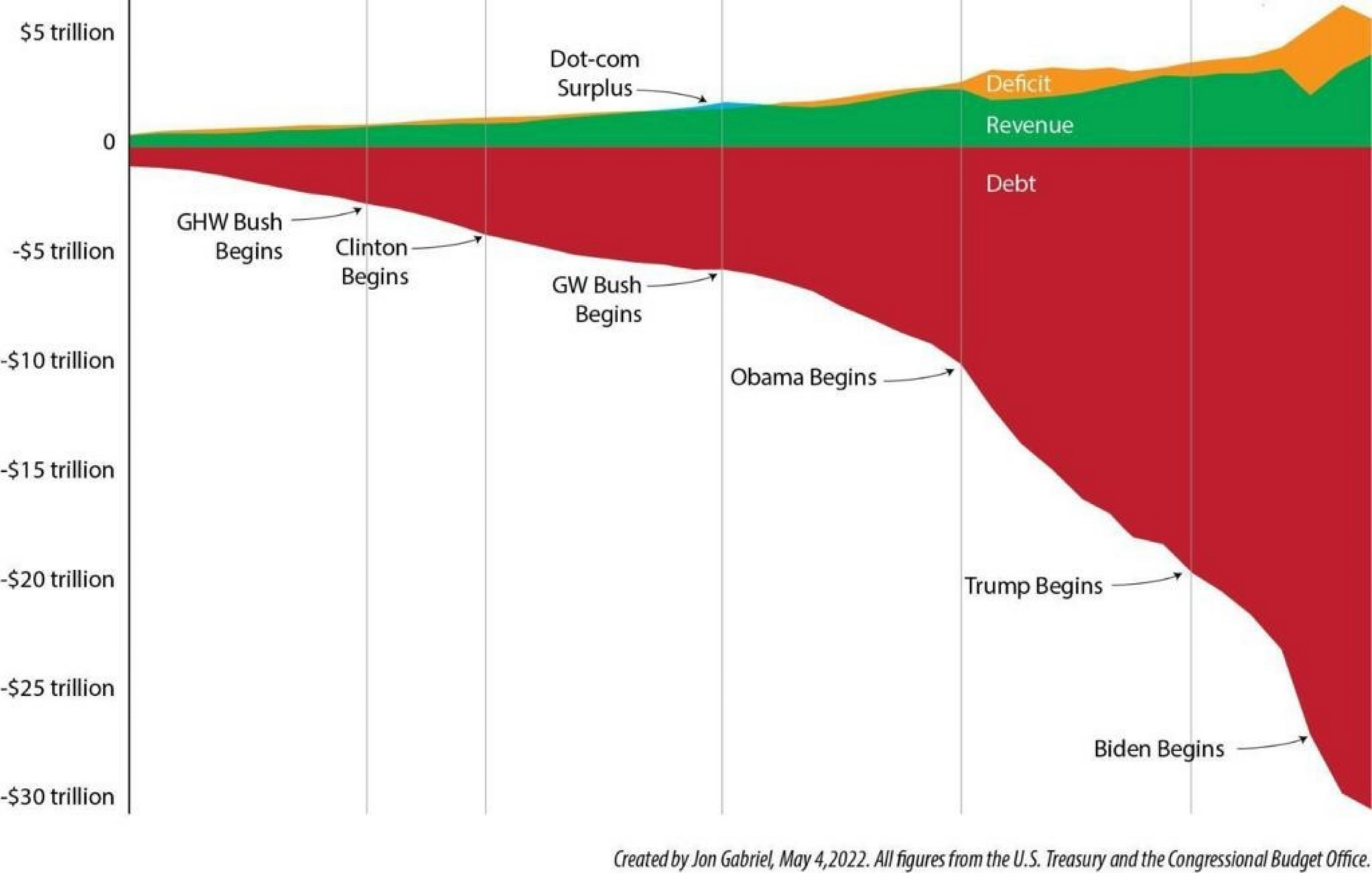

When we talk about the printing of trillions, what we’re really talking about is whether the US will default on its debt, and how and when it does so.

Start with the increasingly topical question of whether the US will default. Worthies from both parties think that either (a) the US can run up infinite debt without consequence or (b) the US can somehow pay down its debt to a manageable level via “normal” mechanisms, by cutting spending or boosting revenue.

Others don’t believe the US can or will pay its $31T+ in debt. Not without printing trillions, at least. That’s what Ray Dalio says. Nouriel Roubini too. And arguably even Warren Buffett and Alan Greenspan. They all say it in different ways, namely that the US can technically extinguish its debt…by printing. This is called “monetizing the debt” or “debasing the currency”. If you’ve ever glanced at the US debt graph, you know something like this is coming, because all the savings in America aren't enough to pay that bill.

At that point the question is how and when.

- First, how will the US default? Is it hard default where some are explicitly told they aren’t getting paid, like the ongoing debt ceiling crisis? Is it soft default where trillions is printed to pay the obligations in nominal terms? Or is it perhaps a chaotic mix of both?

- Second, when does the US default? Is it months, years, decades, or centuries?

How — and when?

Months, years, decades, or centuries?

Here’s how one might make the case for US default in months, years, decades, or centuries.

- The case for months is debt ceiling, explicit US sovereign default, and banking crisis.

- The case for years is both of those factors, plus the dozen other crises described in the video, plus all the factors Dalio and Turchin enumerate, plus the domestic chaos of the 2024 election.

- The case for decades is all of the above, plus more gradual de-dollarization and the continued relative decline of G7 GDP share relative to the BRICS.

- And the case for centuries is that there’s a great deal of ruin in a nation, and the system will somehow muddle through. Most people land here by default. After all, the system has made it through the Civil War, the Great Depression, the World Wars, and 30+ recessions. So they assign 100% probability to a life expectancy of centuries.

That’s really what it boils down to.

If you believe there’s a high probability of these simultaneous economic crises causing a massive print in 90 days, 900 days, or even 90 months — then you expect some kind of default, and you expect fiat crisis. And you’ll want to be prepared, whatever that means to you.

But if you believe the system has centuries to live, that the banking crisis isn’t a big deal, that de-dollarization isn’t happening, that only dumb banks didn’t hedge the Fed’s rate hikes, that politicians will do the right thing after doing everything else, and that the Fed has printed its way through the last umpteen years so it’ll just be more of the same in 2023…then you do not expect default, and you do not expect fiat crisis.

Of course, the idea that the system will fail at any moment has been the permabear position for the last 15 years. I like ZeroHedge, but they’ll be the first to admit that in a system where every economic indicator is expertly faked – from the AAA ratings on subprime mortgages to the solvency of massive banks – it’s hard to say when something will be “allowed” to fail.

Yet on the other hand, those who warned of the financial crisis before 2008 “were dismissed as doom-mongers and [the] property bubble was allowed to inflate absurdly.”

While it might sound like it in this post, I’m really not a "doom-monger" at all. The only other time I've ever raised an alarm like this was January 2020, months before COVID-19 went viral. Indeed, most people most of the time would consider me a techno-optimist!

But I am a realist. And personally, I think the US has a 10% chance of defaulting in months, 70% chance in years, a 19% chance in decades, and a 1% chance of making it to centuries, whether that default be explicit (via something like the debt ceiling) or more likely implicit (via money printing).

I don’t think default is the “end of the world” (not even the world wars were!) but I do think it’s going to be a disruptive period that merits careful preparation, as opposed to either passivity or panic.

Nevertheless, I’m still optimistic on individual Americans, on America at at the state and local level, and on technological progress globally. In fact, there’s much to be said in later posts on ways that people can survive and even thrive in this environment.

But before we can talk about solutions, we need to first determine whether there’s a problem. You’ve now watched the video, clicked the links, and read the post. Make up your own mind below.

MONTHS, YEARS, DECADES, OR CENTURIES?

— Balaji (@balajis) May 2, 2023

If trading, too early is being wrong.

But if preparing, hell is truth seen too late.

So I don't care that much about timing.

Being early on something like this is being right.

That said, when does the fiat crisis kick off?

It's famously…

Footnotes

[1] To be clear, I do sincerely believe that there is a small-but-nonzero probability that the economy could suffer a rapid collapse. So do Larry Summers, the Washington Post, and the markets themselves...all of which have pegged the probability of near-term US sovereign default at all time highs. That’s one way to understand the bet.

But even if you just think of the bet as a type of public service announcement, it easily ratio’d the New York Times by a factor of 30X+. Sulzberger spends $170M+/month ($2.05B/year) for 604.6M pageviews in March 2023, whereas this PSA cost a mere $1.5M in a month for 162.5M direct pageviews. Citizen journalism defeats corporate journalism once again!